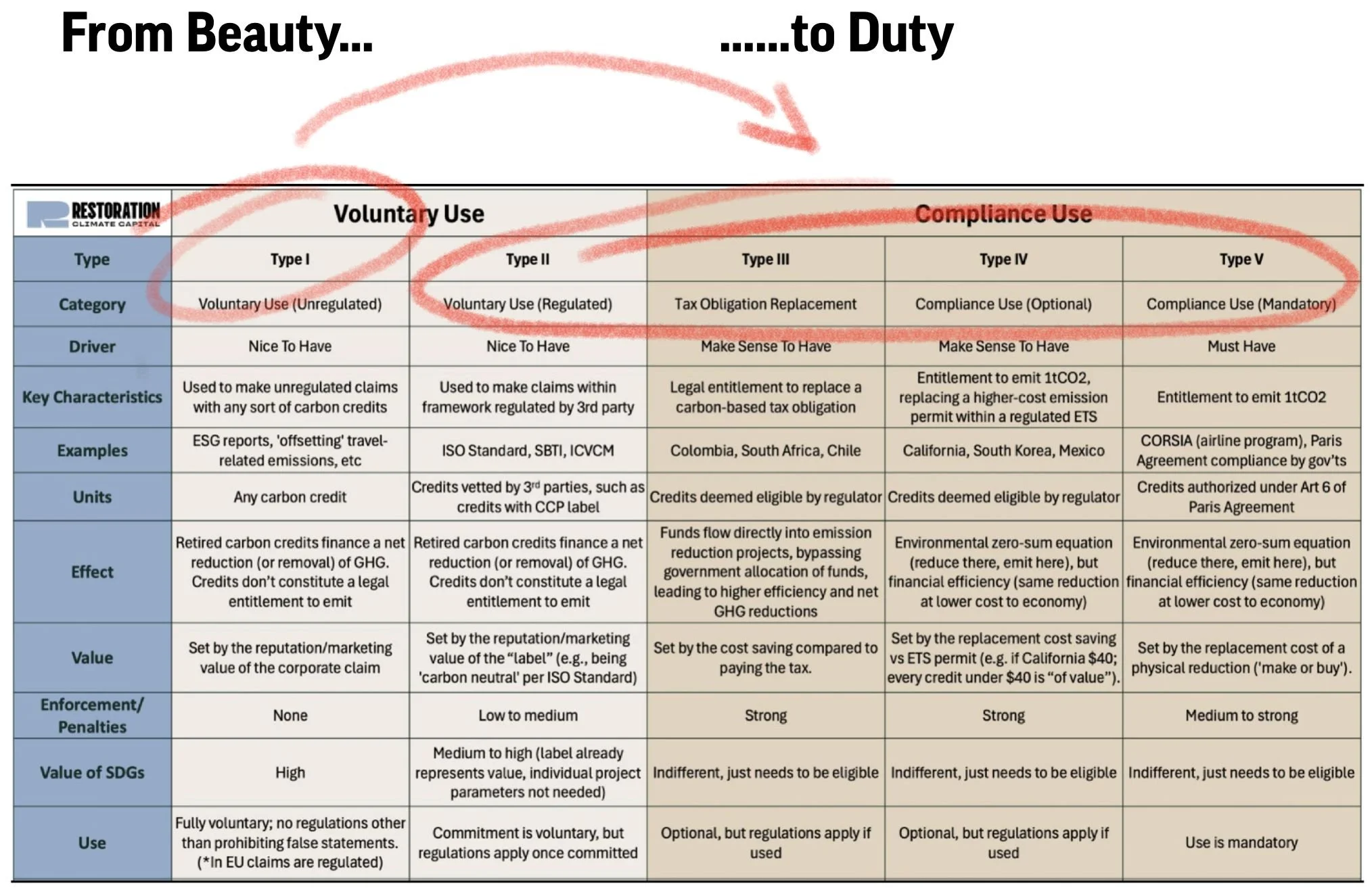

From Beauty to Duty

June 15, 2025

Recent weeks have seen a flurry of announcements from governments backing the use of “high integrity” carbon credits. The UK, Singapore, and Kenya announced “The Coalition to Grow Carbon Markets”[1], which, together with the recent “Pledge for High-Integrity Use of Carbon Credits,” prepared by the French government, signals a profound transformation in the Voluntary Carbon Market (VCM).

As carbon markets rapidly mature, we believe the key question will shift from “What are the best carbon credits?” to “Which credits are good enough?”.

This transformation - from “Beauty” to “Duty” - could fundamentally transform the current use of project-based carbon credits. Here’s why:

Historically, corporate buyers justified the cost of carbon credits primarily through their “carbon neutral” marketing value. Not necessarily to “greenwash,” as some media claim, but to demonstrate environmental leadership. They wanted to somehow demonstrate that they go beyond the regulated reductions and “voluntarily” compensate their products’ or company’s footprint.

The media scrutiny, however, had two effects:

Buyers bore the full reputational risk of every credit purchase, causing many to withdraw or at least delay market participation, and

The broader carbon community responded with significantly improved project oversight and quality.

Yet today, in the midst of what many consider a climate emergency, the size of this results-based climate finance mechanism remains comparable to the market for fake eyelashes (~$2B… is this really the best we can do when faced with fundamental environmental problems?).

Imagine this: a buyer calls a bank and secures guaranteed delivery of 100,000 “good enough” carbon credits per year for five years. Buyer hangs up. Deal done. No reputational risk. No months-long, expensive due diligence. No need to agree on a third-party project rating. The credits are “good enough” by default.

In this scenario, the risk is outsourced to experts, just as we’ve seen in other environmental commodities like RECs or LCFS credits. If carbon credits become interchangeable, sellers (or insurers) can “backfill” any shortfall or “bad apples” with other fungible credits. Thus, the buyer can receive delivery of carbon credits which are endorsed by governments and guaranteed by the seller.

In essence, we need a simple “Buy Button” to lower the entry barrier and thus unlock carbon credit demand and, with it, funding for hundreds of projects. Of course, “simple” isn’t always easy. To achieve simplicity, we need to reach a broad consensus on which carbon credits are “good enough”.

Two such groups of “good enough” credits are emerging:

Credits authorized under the Paris Agreement’s Article 6.4

Credits adhering to ICVCM’s Core Carbon Principles (CCP)

Setting the standard is the UN regulated oversight of issuance under Art 6.4, with which the principles developed by the ICVCM very closely align. In fact, they are often even more stringent than the UN rulebook.

Once standardized, credits can be traded on exchanges, bringing price transparency, and, equally important, the creation of indices. Price indices serve as a critical piece of the puzzle for the development of efficient financing mechanisms, enabling financial institutions to mark their books and thus to participate in the market.

To be clear, we are not saying all carbon credits should be worth the same. Co-benefits deserve a premium. But we do need liquidity and risk transfer mechanisms to scale. In fact, an index could actually help to price co-benefits (e.g., index + $X for high-impact projects).

Momentum is building:

Art. 6 is supported by the aviation sector’s CORSIA initiative and an increasing number of governments

CCPs are championed by a growing number of governments

SBTI and ISO Standard, two major industry associations, are exploring alignment with the above standards.

Agreeing on what’s “good enough” won’t solve every problem. But moving from Beauty to Duty will solve the right ones first — unlocking capital, enabling scale, and finally moving the needle in terms of reducing global GHG emissions.

[1] https://vcmintegrity.org/coalition-to-grow-carbon-markets/